r&d tax credit calculator 2020

If your business is spending money to create a new product or process or improve upon an existing product or process then you. Then youll need to have the following figures on hand.

R D Tax Credit Calculation Examples Mpa

For Technology Ecommerce Bio-Tech Industries More.

. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. For startups applying the credit against payroll taxes is a valuable non-dilutive funding opportunity. Average calculated RD claim is 56000.

The Inflation Reduction Act of 2022 passed August 12 2022 increases the RD Tax Credit amount from 250000 to 500000. Of Employees involved with RD. You can then offset the RDEC against your tax bill or where there is no tax payable you will receive the net amount as cash.

Find out how much your business could be due using our free RD tax credit calculator. Ad Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process. RD Tax Credit Calculator.

The results from our RD Tax Credit Calculator are only estimated figures and actual numbers will vary depending on the specific circumstances of the business. We will show you how. The money companies spend on technology and innovation can offset payroll and income taxes through RD Tax Credits.

Total Amount spent on 3rd Parties involved with RD. Need help filing for your RD Tax Credit. What expenses qualify for the research.

Your RD activity is conducted on US. We will update our websites content in the coming days. We only charge IF we determine you are entitled to a tax credit.

This is a dollar-for-dollar credit against taxes. Calculate RD tax relief in under 3 minutes. All Extras are Included.

Visit our already updated RD Tax Credit Calculator to estimate your startups possible tax credit under this new legislation. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table. In RD tax relief based on the RD tax credit rates as of 1.

Premium Federal Tax Software. What is the RD tax credit worth. Of supplies used in RD.

This is a dollar-for-dollar credit against taxes owed. Free RD Tax Calculator. The RD tax credit calculation can be done under the regular research credit method or the alternative simplified credit.

If you would like a detailed analysis of the potential benefits or. What types of activities qualify for the RD Tax Credit. Total number of employees in your business.

RD Tax Credit Calculator Nick Tantillo 2020-02-12T2354170000. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Many activities qualify for the RD tax credit and the Eide Bailly RD tax credit calculator can provide you with a high-level estimate of your potential credit.

RD TAX CREDIT CALCULATOR. The RDEC is paid as a taxable credit of your RD costs. Tax credits calculator - GOVUK.

Startup RD Tax Credit Calculator. With just a few clicks - we can estimate your refund. For example if you spent 200000 on RD last.

RD Tax Credit Estimating Tool. Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax. Calculate how much RD tax relief your business could claim back.

Plus it carries forward 20 years. Estimate RD tax relief for your business. Use our simple calculator to see if you qualify for the RD tax credit and if so by.

Ad Everything is included Premium features IRS e-file 1099-MISC and more. RD Tax Credit Calculation. The current rate for the RDEC is 13.

The Recovery Friendly Workplace Tax Credit Is Designed To Reward Eligible Employers. Our experienced tax team will analyze your investment in new technology development to help you get real non-dilutive cash. Because it is taxable the cash benefit youll receive is 11 after tax.

01633 860 021 hellozesttax. Checking your eligibility is simple enough if you fall under any of the following four categories you may be able to claim this tax credit. For most companies the credit is worth 7-10 of qualified research expenses.

Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator. Home RD Tax Credits Calculator. Enquire now so Lumo can fully optimise.

RD Tax Credits Calculator.

Easy Solar Tax Credit Calculator 2021

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Property Tax How To Calculate Local Considerations

R D Tax Credit Calculation Adp

R D Tax Credit Calculation Methods Adp

R D Tax Credit How Your Work Qualifies Alliantgroup

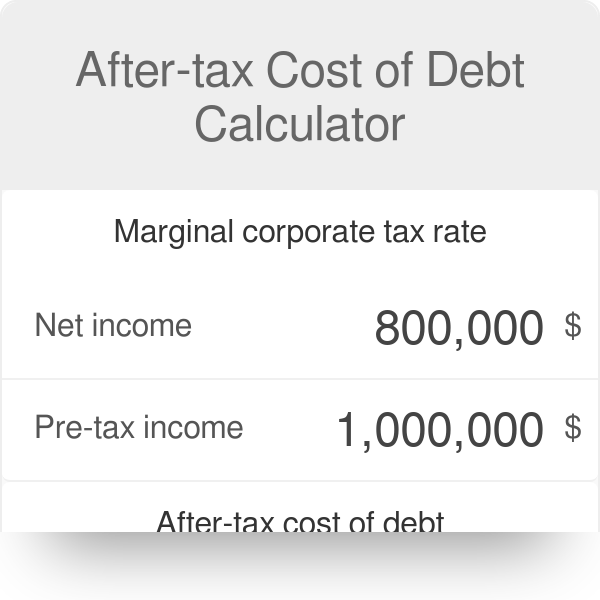

After Tax Cost Of Debt Calculator Required Return Of Debt

R D Tax Credit Calculation Examples Mpa

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Easy Solar Tax Credit Calculator 2021

The Business Research Company Global Market Research Reports Global Iot Sensors Market Report Trends Lead Generation Marketing Marketing Trends Marketing

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

What Are Marriage Penalties And Bonuses Tax Policy Center

Tax Payment Concept State Government Taxation Calculation Of Tax Return Man Fills The Tax Form Documents Calendar Calculat In 2022 Irs Taxes Tax Debt Tax Payment

:max_bytes(150000):strip_icc()/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

What Is The Tax Impact Of Calculating Depreciation

R D Tax Credit Calculation Examples Mpa

Taxes On Forgiven Student Loans What To Know Student Loan Hero

Taxable Income Formula Examples How To Calculate Taxable Income