s corp tax rate calculator

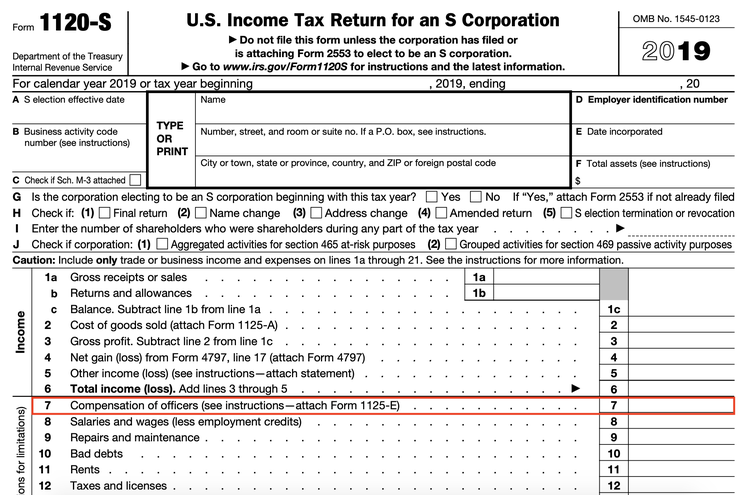

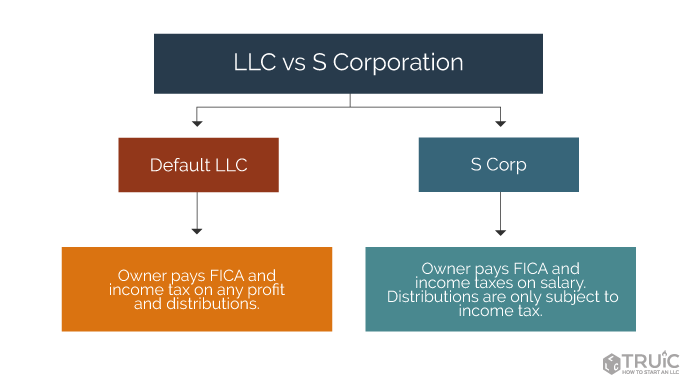

If you are a nonresident or part-year resident you must complete Form. They are charged at a rate of about 153 percent of the wages with the employee and the S corporation contributing half of the tax.

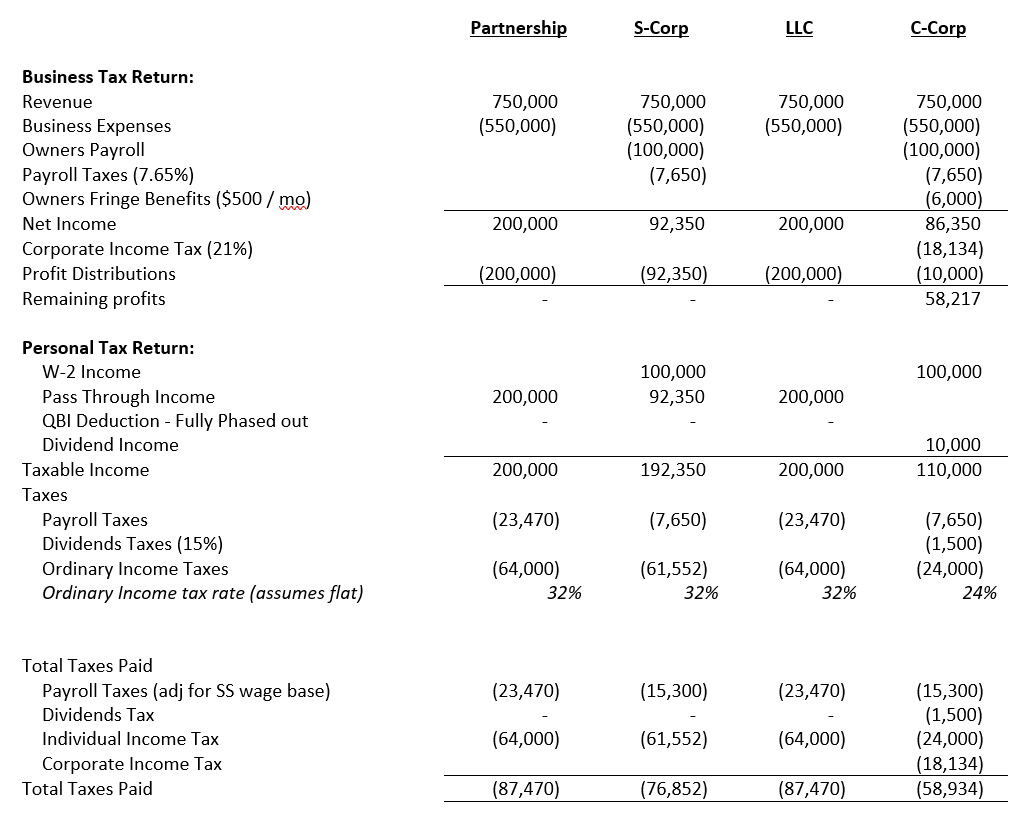

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

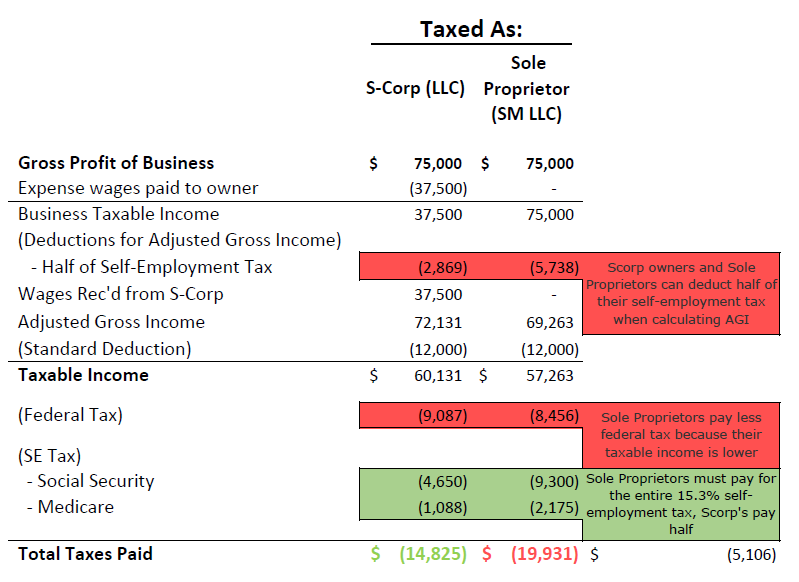

Lets look at some numbers to see how this works.

. Additional Self-Employment Tax Federal Level 153 on all business income. Gross to Net Net to Gross Tax Year. S Corporation Subchapter S and S Corp Tax Rate.

In the event that net corporate income tax receipts for a fiscal year. S corporation the S corporation should provide your proportionate share of the S corporations depreciation deduction. This is the total of state county and city sales tax.

Instead you only pay payroll taxes on the salary you earn from your S corp. The taxes are filed quarterly using Form 941. From the practical example above the total tax due was 9574.

Estimated Local Business tax. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business. The SE tax rate for business owners is 153 tax.

This rulemaking implements changes to the corporate income tax rates contained in 2022 Iowa Acts House File 2317. For example if you have a. Annual state LLC S-Corp registration fees.

For 2023 theyre still set at 10 12 22 24 32 35 and 37. What is the sales tax rate in Ridgefield Park New Jersey. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount. For example if your one-person S corporation makes 200000 in profit and a. When you divide the tax payable with the taxable income of 63000 and multiply by 100 you get 152.

You can figure out the effective tax rate for your corporation by dividing the cost of taxes by the pre-tax earnings. Say you earn 150000 in revenue as the owner. 2 days agoThe tax rates havent changed since 2018.

This additional tax covers Social Security Medicare taxes that would normally be paid on your W2 income S. However the tax brackets are adjusted or indexed each year to. Total first year cost of S-Corp.

As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will drop to. Annual cost of administering a payroll. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. The minimum combined 2022 sales tax rate for Ridgefield Park New Jersey is. How Do I Calculate the Effective Tax Rate for My Corporation.

OLPMS - Instant Payroll Calculator. 2023 Federal Income Tax Bracket s and Rates. An S corporation S corp is a tax structure under Subchapter S of the IRS Internal Revenue Service for federal state and.

Social Security and Medicare.

A Beginner S Guide To S Corporation Taxes

New York City Taxes A Quick Primer For Businesses

Small Business Tax Calculator Taxfyle

S Corp Taxes S Corp Tax Benefits Truic

What Is An S Corporation And Should You Form One Bench Accounting

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Getting Started Bloomberg Tax Bloomberg Tax

S Corp Tax Savings Calculator Newway Accounting

S Corp Federal Tax Filing Dates Turbotax Tax Tips Videos

Tax Liability What It Is And How To Calculate It Bench Accounting

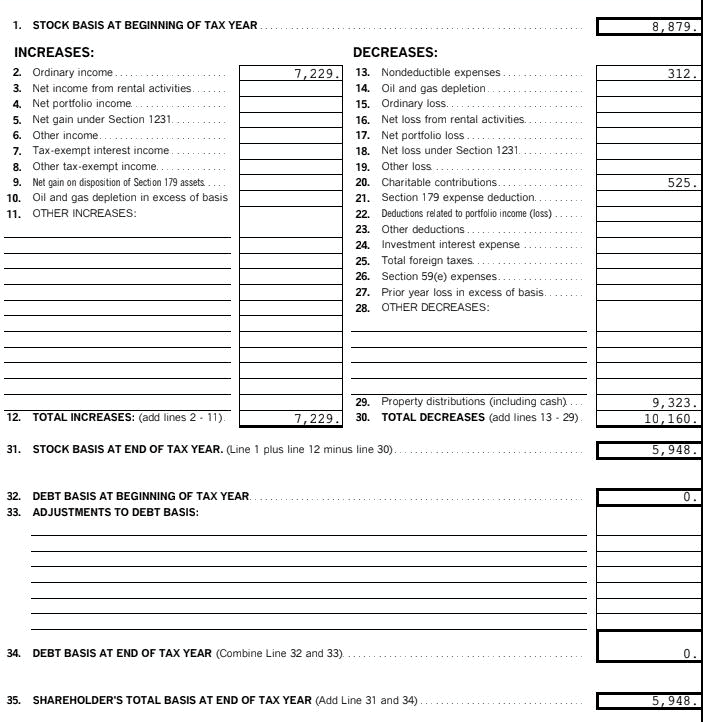

What Is The Basis For My S Corporation Tl Dr Accounting

Tax Savings Calculator For Llc Vs S Corp Gusto

Try Our Free Corporation Tax Calculator Biztaxwiz

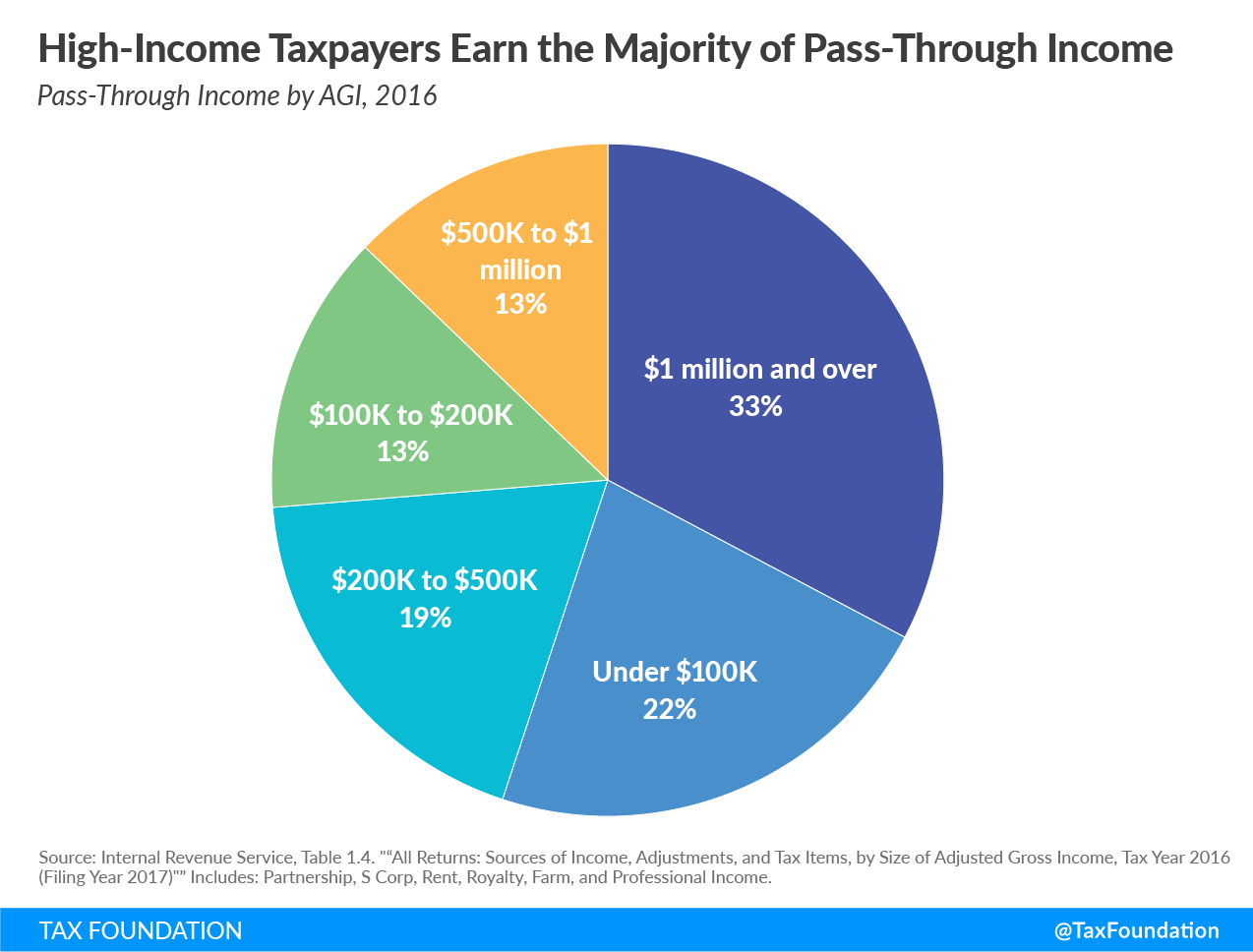

What Is A Pass Through Business How Is It Taxed Tax Foundation

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Tax Liability What It Is And How To Calculate It Bench Accounting

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant