betterment tax loss harvesting joint account

Betterment offers tax-loss harvesting in taxable. The Goals and Benefits of Betterment Tax Loss Harvesting.

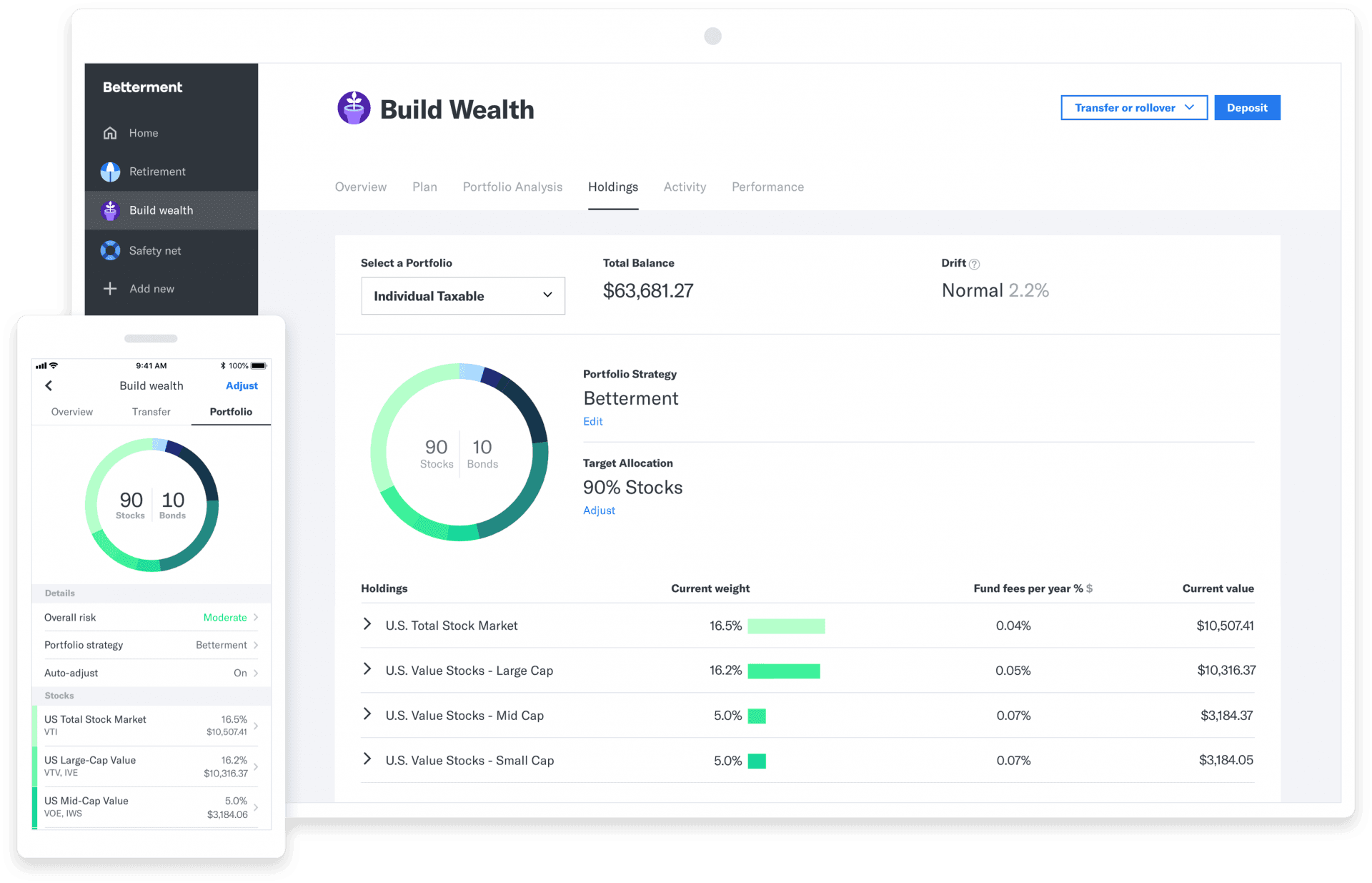

Betterment Review 2022 What You Need To Know About This Robo Advisor

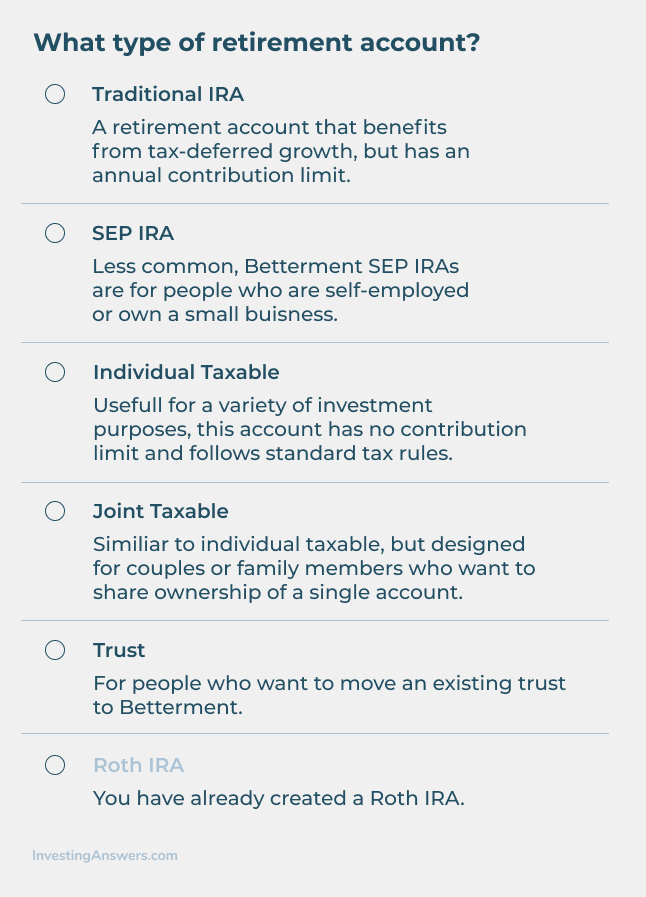

Theres no impact on IRA traditional or roth accounts.

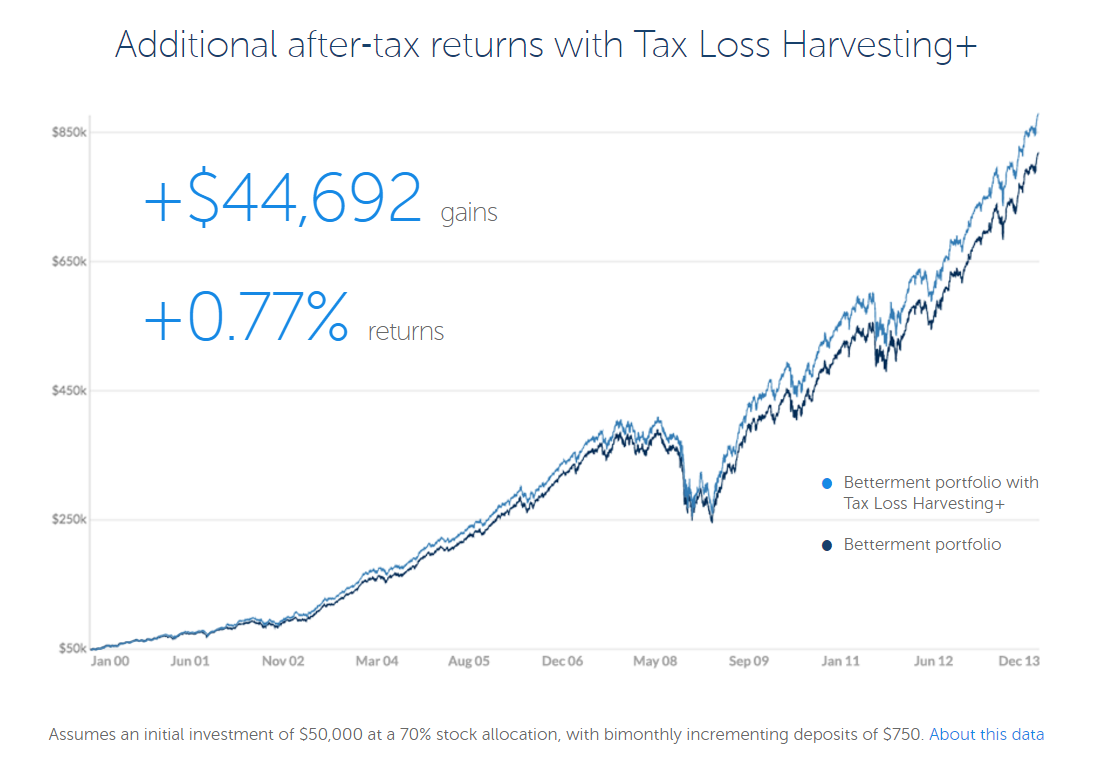

. In its white paper on the Betterment tax loss harvesting program Betterment goes into detail about many issues surrounding ETF. Tax-Loss Harvesting is a strategy that takes advantage of movements in the markets to capture investment losses which can reduce your tax bill leaving. Betterments use of tax-loss harvesting is a huge benefit to efficiently use capital losses to offset your tax liability.

So no need to turn it on until you have a taxable account. What is a joint account. Betterment needs to rethink if it belongs in banking.

Betterment offers tax-loss harvesting on taxable accounts. Betterment and Wealthfront made harvesting losses easier and more. Betterment should give up on banking and stay in investing.

When you enable TLH on your Betterment account youll be asked for your. Tax loss harvesting only applies to taxable accounts. In its white paper on the betterment tax loss harvesting program betterment goes into detail about many issues surrounding etf investments and how.

However this does not mean you will not owe any taxes. Both Wealthfront and Betterment offer tax-loss harvesting for their taxable accounts while making sure to avoid wash sales. Tax-loss harvesting has been shown to boost after.

Sophisticated investors have been harvesting losses manually for decades to acquire tax benefits. Both M1 Finance and Betterment offer tax-advantaged retirement accounts but the support on taxable accounts is different. Insufficient fund transaction is holding up cash for over 3 days and.

If your joint account is with your spouse and you file your taxes jointly you can enable TLH. US resident opens a new IBKR Pro individual or joint account receives 025 rate reduction on margin loans. This process minimizes taxes by selling.

Betterment Taxes Summary. Betterment increases after-tax returns by a combination of tax-advantaged strategies.

Betterment Account Openings Skyrocket 116 In First Quarter Investmentnews

Betterment Vs Wealthfront Which Investing App Is Right For You

Betterment Review Safe Robo Advisor For Beginners

Betterment Review Automated Investing And Robo Advisor

Betterment Review How Does This Robo Advisor Compare

Betterment Vs Sofi Invest 2022 All Features Compared

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Review 2022 The College Investor

Betterment Review 2018 Betterment Fees Sign Up Final Analysis Ceo Money From Wfn1

Betterment Review 2022 A Robo Advisor Worth Checking Out

2022 Betterment Review Pros Cons More Benzinga

Betterment Vs Wealthfront Which Ira Is Right For You

Acorns Vs Betterment The Key Differences Explained

Tax Loss Harvesting Rules How To Tax Loss Harvest White Coat Investor

Is Betterment Safe Find Out In This Betterment Review 2022

Betterment Review Smartasset Com

Three Keys To Managing Joint Finances With Your Partner

Betterment Review 2021 The Original Robo Advisor The Dough Roller